Understanding SME Finance & regional difference

Written by: Mike Conroy, Director, Commercial Policy, UK Finance

Published: 10 February 2020

The financing of the UK’s small and medium sized business sector (SMEs) is an important issue for policy makers given the sector’s great significance to the UK economy.

Why? Because there are around 5.9 million SMEs that make up 99 per cent of all businesses in the UK and they are located all over the country. They provide vital products and services to all of us and they come in various shapes and sizes; companies with zero employees who sell their expertise and time, small shops, restaurants, builders, small tech firms – the list is long and diverse. This diversity and difference means that national statistics about SME lending never tell the whole story.

The just-published Bank of England SME lending statistics revealed a 12-month growth of loans of 0.9%, which is up from 0.1% in December 2018. New lending was around £57 billion with overdraft and lending stock growing to nearly £168 billion. This growth was achieved despite depressed business confidence and a reported reluctance to borrow due to economic uncertainty.

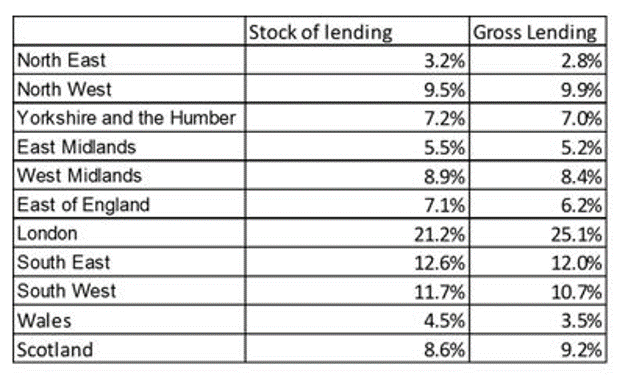

Given differences of economic performance across the country, there is a worry that regions outside of London and the south east are disadvantaged when it comes to access to bank finance. A cursory glance at the figures might draw you to that conclusion. In the table below you will see that 25 per cent goes to London and three per cent to the north east.

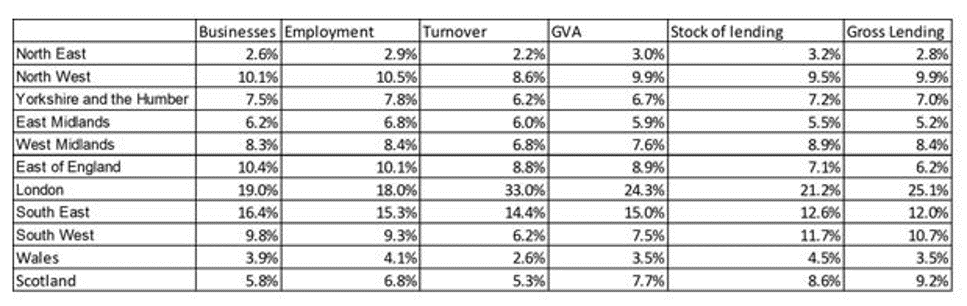

However, these figures do not reflect the profile of the economy of the region, including the number of businesses in the region, the size of these businesses and other demographics such as industry sector, ambitions to grow and how the need to borrow drives demand.

The table below adds some additional data; the stock of businesses, employment, turnover and Gross Value Added. You will see that bank finance remains well spread across the UK and is consistent with the business population and size of firm. It is importantly also true of the flow of new lending.

Lending approval rates of around 78 per cent are also consistent across the regions.

This data is helpful in explaining some of these regional differences, but there are other factors at play. Other sources of data and research, such as the SME Finance Monitor, identify regional differences based on demographic factors.

For example, 42 per cent of businesses in Yorkshire and Humberside have a worse than average credit rating compared with 56 per cent in London. Businesses in London are twice as likely as businesses in Yorkshire and Humberside to be trading internationally. 49 per cent of businesses in London say they are prepared to take risks to succeed compared with 38 per cent in the east Midlands.

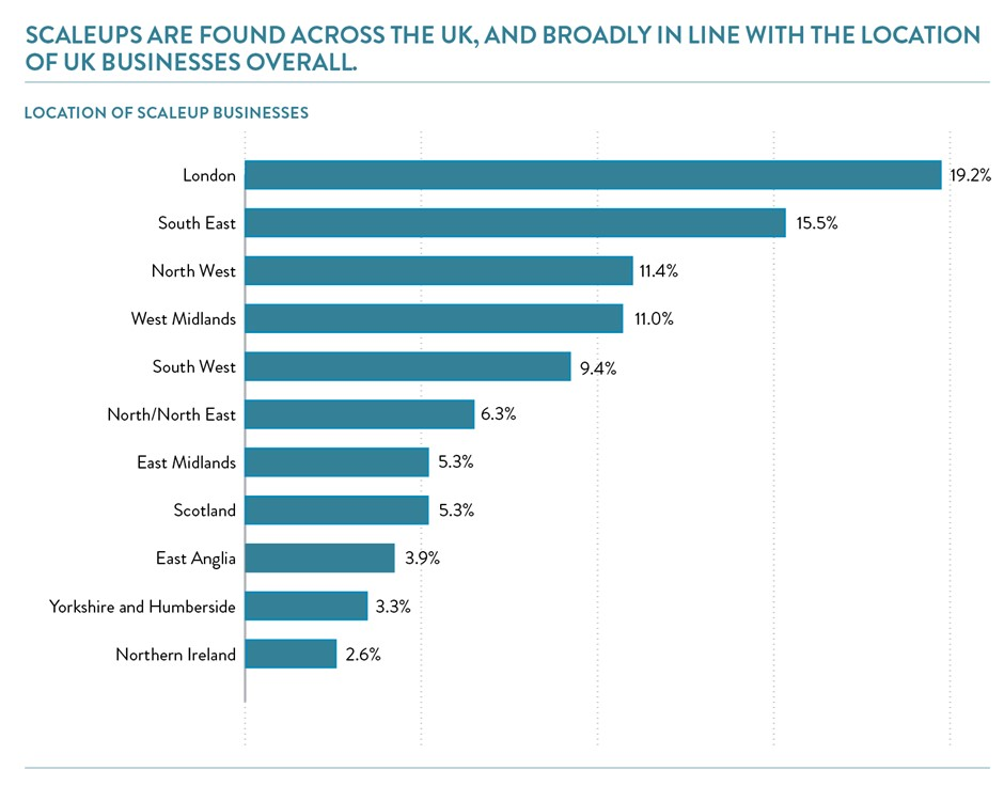

Some regions have higher concentrations of ambitious growing firms, known as scaleups than others, as shown in the table below. This distribution, like bank lending, is in line with the distribution of businesses in the UK.

The financing of the UK’s small and medium sized business sector (SMEs) is an important issue for policy makers given the sector’s great significance to the UK economy.

Some regions have higher concentrations of capital-intensive businesses, such as manufacturing in the Midlands, and some are simply more conservative in their attitudes to finance. Here there is a question as to whether contrary to the pattern of debt finance, the concentration of equity finance to support scale up businesses is holding back development. Actions to address that are now crucial.

Understanding the regional supply and demand for finance is vitally important to regional economies and to the country as a whole and there is a need to deepen access to finance insight in and across the regions. We will work with our stakeholders and members to do so.